Windfall, in other words, is nothing but receiving a large amount once in bulk. Of course, the reason may be anything for such. For example, lottery, inherited wealth, receiving a significant price for an asset you think is worthless, etc. But I realize that they can make your finances straight if you know how to handle them right. So in this post, I will mention what I think, What I found on the net, and What I get from Experts.

Windfall, in other words, is nothing but receiving a large amount once in bulk. Of course, the reason may be anything for such. For example, lottery, inherited wealth, receiving a significant price for an asset you think is worthless, etc. But I realize that they can make your finances straight if you know how to handle them right. So in this post, I will mention what I think, What I found on the net, and What I get from Experts.

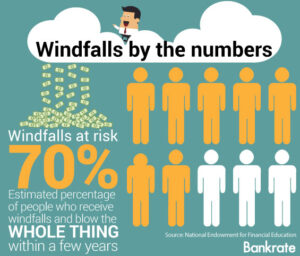

Vast sums of money aren’t a guarantee for an easy life. Lottery winners tend to file for bankruptcy at the double the general population’s rate. A Sports Illustrated investigation found that 78% of NFL players file for bankruptcy or experience financial difficulties within two years of retirement. In addition, 70% of families lost control of their assets in the first generation following wealth transfer, according to a 2010 survey of more than 2,000 wealthy families by The Williams Group, a wealth management firm.

When I started reading and studying for this post, I realized that this is a profound subject that is mainly ignored. I also found that people think windfalls are about money. But it’s all about change and transition. Suddenly receiving colossal cash is not something you can expect every day. It is like changing everything in minutes and people need time to adjust. The situation is not at all monetary but Psychological. Unexpectedly getting as little as three months’ worth of salary in a lump sum can set off a chain reaction of panic, guilt, and fear for some, according to psychologist Dennis Pearne, co-author of “The Challenges of Wealth” and a wealth counselor and consultant based in Framingham, Massachusetts.

The shock of a sudden windfall can set off a litany of irrational behaviors, such as giving all the money away, becoming a hermit, spending the money lavishly, or hiding or hoarding the money. Other hallmarks of money shock include engaging in self-destructive and expensive activities such as substance abuse, gambling, and sex addiction. People don’t understand the limits of this new wealth. What they think is unlimited money which it is not.

So How to handle such windfall.

- Money Moratorium: Do nothing for at least 3-4 months. Park your money safe where it won’t depreciate and take a money holiday. Keeping your life the same for that time is one of the best ways to handle it.

- If you are considering quitting your job, don’t do it, for god’s sake.

- Enjoy but in limit: Earmark 10% of your cash as fun money but by maintaining your current lifestyle. This is supposed to be your final option.

- Avoid spending and investing heavily. If needed, take help from a professional.

- Check your financial planning: Use the money for your goals that are lagging. Make sufficient provision for your essential goals like Retirement.

- Talk with a Financial advisor: You should have a trusted adviser to act as a buffer between you and the legions that want a piece of your wealth.

- Build some assets which will take care of you in the future.

- Create a plan for the full money. Allocate and make the budget. If you do not need real money at once, invest it in fixed income or less risky assets.

- Repaying your outstanding debts has a high cost.

- Review after one year what is changed. What is right and what is not changed.