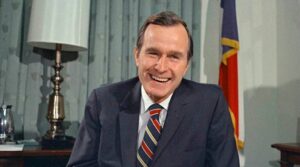

George H W Bush was the 41st President of the United States, serving from 1989 to 1993. He was born in Milton, Massachusetts, in 1924, and grew up in a politically active family. After serving in World War II, Bush attended Yale University, where he was a member of the Delta Kappa Epsilon fraternity and played baseball.

Following his graduation from Yale, Bush entered the oil business and became a successful businessman. In the 1960s, he entered politics, serving as a member of the House of Representatives and later as the U.S. Ambassador to the United Nations. In 1980, he was elected Vice President under President Ronald Reagan.

In 1988, Bush was elected President in his own right, defeating his Democratic opponent, Michael Dukakis. As President, Bush is perhaps best known for his foreign policy achievements, including the collapse of the Soviet Union and the end of the Cold War.

During his presidency, Bush also oversaw the Gulf War, in which a coalition of countries led by the United States successfully expelled Iraqi forces from Kuwait. He also signed the Americans with Disabilities Act, which prohibits discrimination against individuals with disabilities.

Despite these accomplishments, Bush faced challenges during his presidency, including a recession and criticism for his handling of the savings and loan crisis. He was defeated in the 1992 election by Bill Clinton.

After leaving office, Bush returned to private life, but he remained active in public service and charitable work. He passed away in 2018 at the age of 94. He is remembered as a dedicated public servant who worked to promote peace and improve the lives of Americans.

So when I was going through his life for my blog, I realize that this guy is known for one famous bite about tax. “Read my lips: no new taxes” is a phrase spoken by American presidential candidate George H.W. Bush at the 1988 Republican National Convention as he accepted the nomination on August 18. The line was written by speechwriter Peggy Noonan and was the most prominent sound bite from the speech. No, George H.W. Bush did not keep his promise of “no new taxes.” It will go down as one of the most famous broken promises in political history. As a Republican president, that was a sufficiently heavy mistake for him, and his voters. In 1990, under pressure to strike a budget deal with the Democratic-controlled Congress, Bush relented and agreed to hike taxes. here I remember. Barack Obama or should I say, the current situation of Joe Biden. That sealed his fate of him as a one-term president. While studying US presidents I learn some important things about why someone can be one term and not get reelected. The 1992 United States presidential election was held on November 3rd. George H.W. Bush lost the election to Bill Clinton. Many factors contributed to his loss, including a weak economy and high unemployment rates. The lost promise of no new tax was one.

Government tax policy can have an impact on a country’s economic growth rate. Different types of taxes can have different effects on economic growth. For example, a study examining the relationship between tax structure and state-level growth performance in India for the period 1991–2016 found that income tax and commodity–service tax have a positive impact on economic growth. However, this relationship can vary depending on the specific tax policies implemented by a government and the overall economic conditions of a country.

Many countries have implemented successful tax policies. For example, the Organisation for Economic Co-operation and Development (OECD) publishes an annual report called “Tax Policy Reforms: OECD and Selected Partner Economies” that provides comparative information on tax reforms across countries and tracks tax policy developments over time.

Income taxes can have an impact on economic growth. For example, a study found that marginal rate cuts affecting only the bottom 99 percent led to aggregate economic growth, individual income growth, and a decrease in the unemployment rate. However, this relationship can vary depending on the specific tax policies implemented by a government and the overall economic conditions of a country.

Overall Tax is something that Republican presidents love to take down. I agree that sometimes reducing rates will make big difference. But sometimes the effect was different. The Republican Party has traditionally advocated for lower taxes and smaller government. One of the most significant tax cuts enacted by Republicans in recent history was the Tax Cuts and Jobs Act (TCJA), signed into law by President Trump in 2017. The TCJA made significant changes to the federal income tax brackets and deductions, including a reduction in most of the seven individual income tax rates, an increase in the standard deduction, and a repeal of personal exemptions.

His predecessor from the republican party, George W. Bush’s tax policies included two major tax cuts: the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA). These tax cuts reduced income tax rates, increased the child tax credit, and reduced taxes on capital gains and dividends. According to some estimates, these tax cuts added an estimated $1.5 trillion to the debt from 2002 to 2011. In addition to reducing income tax rates, increasing the child tax credit, and reducing taxes on capital gains and dividends, the Bush tax cuts also included other changes. For example, they increased the exemption amount for the Alternative Minimum Tax (AMT) and phased out the estate tax. The tax cuts also included a series of tax rebates in 2008 to stimulate the economy during the financial crisis.

Ronald Reagan’s tax policy included significant changes to the United States federal tax code. One of his main campaign promises was to cut the top marginal tax rate, which he did during his presidency. The top marginal tax rate was lowered from 73% to 28% on incomes over just $29,750 – the lowest this rate had been since 1925. In addition to cutting the top marginal tax rate, Reagan’s tax policy included other changes to the United States federal tax code. There were two major tax cuts during his presidency: the Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986. The second tax cut, among other things, cut the highest personal income tax rate from 50% to 38.5% but decreased to 28% in the following years and increased the highest capital gains tax rate from 20% to 28%