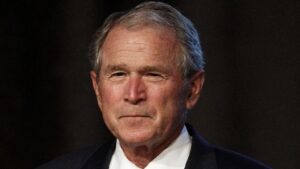

George W. Bush was the 43rd President of the United States, serving two terms from 2001 to 2009. He was born on July 6, 1946, in New Haven, Connecticut, the oldest son of George H. W. Bush, the 41st President of the United States, and Barbara Bush.

Before becoming President, Bush served as the Governor of Texas from 1995 to 2000. He ran for President in 2000 and defeated Al Gore in a controversial election that was ultimately decided by the Supreme Court.

As President, Bush faced several significant challenges, including the terrorist attacks of September 11, 2001, and the subsequent wars in Afghanistan and Iraq. He also oversaw several domestic initiatives, including the No Child Left Behind Act, which aimed to improve education in the United States, and the Medicare Prescription Drug, Improvement, and Modernization Act, which provided prescription drug coverage for seniors.

During his time in office, Bush faced criticism for his handling of the wars in Afghanistan and Iraq and for his response to Hurricane Katrina, which devastated the Gulf Coast in 2005. However, he was also credited with helping to lead the country through difficult times, including the 9/11 attacks and the financial crisis of 2008.

After leaving office, Bush has remained active in public life, working on issues related to education and health care and participating in several philanthropic endeavors. He has also written two books, Decision Points and 41: A Portrait of My Father.

Overall, George W. Bush’s presidency was marked by several significant events and challenges, both domestic and international. He remains a controversial figure in American politics, with his supporters praising his leadership during difficult times and his critics pointing to his decisions on issues such as the wars in Afghanistan and Iraq.

Well, there are many things I can say about George Bush, but what I can learn and I want to study about him in finance is his government’s response to the global financial crisis. The Global Financial Crisis (GFC) of 2007-2009 was the most significant financial crisis to hit the US economy since the Great Depression. The US government’s response to the GFC was multifaceted and encompassed many different policy interventions involving multiple government agencies and various economic sectors. While the initial response relied primarily on traditional methods and authority, later government actions utilized more unconventional approaches.

President George W. Bush addressed the country on September 30, 2008, saying “Congress must act. …Our economy is depending on decisive action from the government. The sooner we address the problem, the sooner we can get back on the path of growth and job creation” It was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008, amid the financial crisis of 2007–2008. It created the $700 billion Troubled Asset Relief Program (TARP) to purchase toxic assets from banks

The government started taking several steps to attack the crisis. These included helping homeowners to refinance into more affordable mortgages; cutting the target for the federal funds rate; unveiling a plan to support the market for commercial paper; and offering government insurance for money market mutual funds.

On October 3, 2008, President George W. Bush signed the $700 billion Emergency Economic Stabilization Act (EESA) of 2008 after Treasury Secretary Henry Paulson asked Congress to approve a bailout to buy mortgage-backed securities that were in danger of defaulting. By doing so, Paulson wanted to take these debts off the books of the banks, hedge funds, and pension funds that held them.

The bill established the Troubled Assets Relief Program (TARP), which was originally designed around a reverse auction. Troubled banks would submit a bid price to sell their assets to TARP, and each auction was to be for a particular asset class. TARP administrators would select the lowest price for each asset class to ensure that the government didn’t pay too much for distressed assets. However, this didn’t happen because it took too long to develop the auction program.

On October 14, 2008, the Treasury Department used $105 billion in TARP funds to launch the Capital Purchase Program, which purchased preferred stock in the eight leading banks. By the time TARP expired on October 3, 2010, Treasury had used the funds in four other areas: $67.8 billion for the $182 billion bailout of insurance giant American International Group (AIG); $80.7 billion to bail out the Big Three auto companies; $20 billion to the Federal Reserve for the Term Asset-Backed Securities Loan Facility; and $75 billion to help homeowners refinance or restructure their mortgages with the Homeowner Affordability and Stability Plan.

As a Republican President, he is very much interested in the concept of tax cuts. and As a liberal, I agree with part of it as tax cuts help the economy but not at the level where it is needed. As a Republican president, he faced some serious issues like Terrorism. Dependency on the middle east and Russia for oil. In July 2008, President George W. Bush lifted a 1990 executive order by his father, President George H. W. Bush, banning offshore drilling and calling for drilling in the Arctic National Wildlife Refuge 1. He outlined a four-point plan to increase the domestic oil supply. The first step was to expand the domestic oil supply by allowing drilling in the outer continental shelf. He asked Congress to lift a federal drilling moratorium on offshore drilling. He said he would then lift an executive order that also bans drilling. Today what we are witnessing as the United States becomes one of the largest oil drillers in the world, is all due to that.

He was Compared with many presidents for different reasons. But I believe that he definitely made some mistakes like the Iraq war but he also realise the importance of movement and the Troubled Asset Restructuring plan was the right move.